Chief Economics Correspondent

BBC

BBCPresident Trump’s sweeping set of tariffs are intended, in part, to protect American industries, raise money and – as we’ve seen – be used as a bargaining chip.

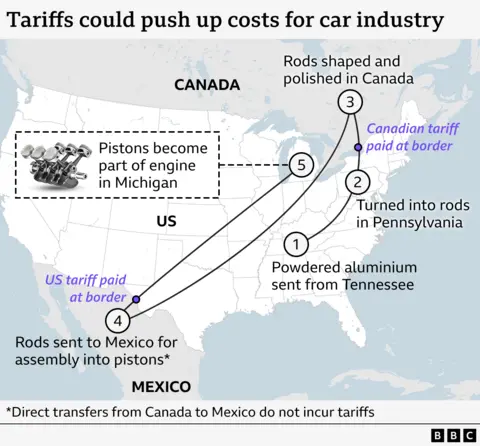

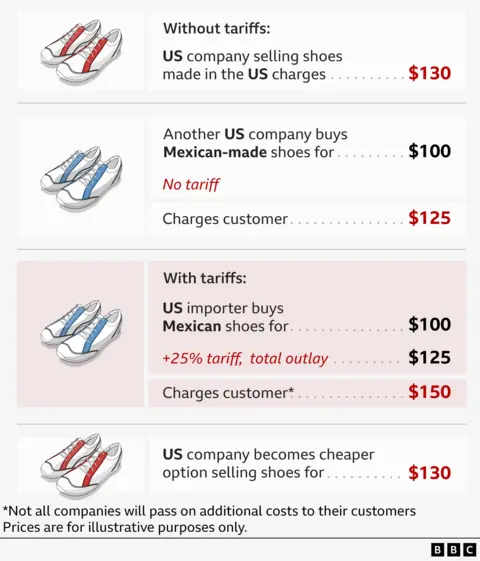

The Republican has already imposed tariffs on imports from China, announced plans for a 25% duty on all steel and aluminium imports, and threatened to place 25% tariffs on Canada and Mexico. We don’t yet know how far he will go, but if what is already on the table comes to pass then it would raise average tariffs to their highest since the 1940s, signalling a new chapter for global trade.

Since the end of World War Two in 1945, tariffs have been broadly viewed as leading to higher consumer prices, less choice and – amidst the inevitable retaliation – backfiring on the industries they were meant to protect. But are we turning our backs on this era?

I hosted a debate with two economic experts in trade policy to unpick the implications of Trump’s policies on America and the world, and explore differing views on who among us might be the biggest winners or losers.

Meet the participants

Meredith Crowley is Professor of Economics at the University of Cambridge. She believes tariffs could lead to a much heavier economic burden on the lowest income people.

Jeff Ferry is Chief Economist Emeritus at the Coalition for A Prosperous America. He believes tariffs can trigger growth and rebuild the US manufacturing industry.

Trump’s ambitions

Dharshini David (DD): President Trump described tariffs as ‘the most beautiful word in the dictionary’ – which is really intriguing. What’s the attraction for him?

Jeff Ferry (JF): I think Trump has made it pretty clear that he thinks tariffs are a ‘beautiful’ thing for several reasons.

Firstly, because they can revive and rebuild the US manufacturing industry. He also sees the US is running a huge trade deficit. In 2024, we had a record goods trade deficit of $1.2 trillion which means the rest of the world, and particularly trade surplus countries, is generating large amounts of revenue by selling to the US market. This gives the US a powerful negotiating tool and we’ve seen him use that, regarding drugs and immigration with Canada and Mexico in the last few days.

Meredith Crowley (MC): My presumption is that what is really concerning Trump is the decline in manufacturing jobs within the United States over the last 40 years.

He observed that lots of jobs that used to exist in the US have migrated to other lower wage countries like Mexico and China and I think his hope would be that by imposing tariffs he could stimulate the creation of jobs.

Retaliation

DD: We know countries are thinking of retaliatory measures as well. To what extent will these measures impact Trump’s economic goals?

JF: There is no doubt that a tariff policy, coupled with an investment and growth strategy policy and a national security policy, will grow the US economy and do a better job of delivering productivity growth than we’ve seen in the last 25 years, which frankly have been abysmal by traditional US standards.

500 years of history shows that the economics profession, in its obsession with short term equilibrium, has done a disservice to not just American workers and the American people, but actually, to British people and British workers – and workers in many countries.

DD: In the post-war era, we saw the tearing down of trade barriers and the idea that globalisation was good. Are we now seeing a backlash against this?

JF: We are seeing a historic shift away from the post WW2 consensus, which stemmed from the period when America was way ahead of the rest of the world – and America was very worried about the Communist threat.

So what you call ‘free trade,’ and I would call the Bretton Woods fixed exchange rate consensus, was designed for America to support and even subsidise the growth of European economies and other economies.

We’ve now moved to a new stage where it’s well known the US economy started to falter in the 1970s, and China has risen to become the world’s number one manufacturing power basically through exploiting all the rules in the system.

We need a new system.

MC: I have a different diagnosis of what happened in recent history.

Over the past 40 years, it’s clear more protection is very popular. Between 1981 and 1994, the US restricted imports of automobiles from Japan and that ultimately had two consequences.

One, it raised the price of automobiles for Americans. Two, in the long run, it led to investment by Japanese manufacturers in the US, and today, the US has a vibrant automobile industry. You could support US industry much more directly by having direct government support.

Trump has now created uncertainty that Canadian manufacturers will have access to the US market in the future. And because Trump made good on his threats in 2018 to impose tariffs on China, major corporations might be revising plans to expand operations in Canada or Mexico to serve the US market. There will be a pullback on real economic activity in those trading partners.

Higher prices

DD: Meredith, Trump has acknowledged there may be ‘a little pain’ for Americans in the short term because as you mentioned, tariffs tend to mean higher prices.

MC: A study on what happened in round one of Trump’s tariffs on China in 2018 showed, in the first two years, that most of the cost increase was absorbed by importers and distributors and it didn’t get passed on to consumers. The price increases though, tend to come more gradually.

Once you realise the tariff is in place permanently, the manufacturer realises everyone’s going to have to pay it and they gradually raise their prices.

One of the concerns economists have is people who buy a lot of goods rather than services tend to be lower income people. So when you put a tariff on things like kids’ trainers, backpacks and clothing, these kinds of consumer items, you’re really placing a much heavier tax burden on the lowest income people in the country, rather than somebody who’s spending their money on vacations and private education for children.

Trade war

DD: Jeff, are you concerned about a global trade war that could backfire on Trump’s aims?

JF: We have been in a trade war since 2001, since China entered the world trading community. The trade war is long-standing. Now America is taking action and a lot of people are throwing up their hands, not because they are concerned about a trade war, but because they’re concerned they might lose a valuable market for their own products.

But I want to go back to consumer prices.

People focus purely on the negative. The purpose of the tariff is to stimulate domestic industry, so on the positive side, you create brand new investments in domestic industry. On the negative side you get a price increase. So it depends critically on the numbers in both cases.

What we know from round one of Trump’s tariffs, between 2018 and 2019, is the price of tariff goods went up, such as steel, but companies committed to building new factories like steel mills which have hired several hundreds of people – great blue collar jobs for people who generally speaking do not have a college degree.

The current phase of globalisation which began around 1990 was just a huge mistake. The idea that the US could compete with Mexico on salaries, particularly to manufacturing workers, was just crazy.

DD: Lets get Meredith’s view on this. Would you agree that for higher wage economies, frankly, globalisation has not been a great idea since the 1990s?

MC: I understand Jeff’s point, that the only concern of the president should be the wellbeing of Americans. But, between 1990 and 2023, the number of people around the world living in extreme poverty on less than $2.15 (£1.75) a day fell from two billion to around 700 million. Over a billion people exiting poverty because of increasing globalisation is an astounding achievement of humanity.

It is completely clear to everyone that within American society the benefits of globalisation have not been equal and so there is a real need within the US to think about how do we improve the wellbeing of less skilled people, and how do we get jobs into the economy to help them.

Where I differ with Trump is I think there are more effective tools. You need an industrial policy or subsidies to production. American productivity is so high because we are constantly investing in labour saving technology but the consequence is that the less skilled have been left behind and their lives are materially worse than they were thirty years ago.

JF: I agree one hundred percent with Meredith.

Equality

DD: This is fascinating. If we see the kind of trade barriers that Trump wants to put in place, what does that mean for this issue of equality?

MC: Once you start putting barriers between countries you create a lot of opportunity for what in the economics world we call monopoly profits. Once you limit entry, the existing producers get to jack up their prices and exploit consumers.

If the US goes into a trade war with China, what’s going to happen to imports from countries the US isn’t interested in having a trade war with?

If the US and China deepen their trade war, this could affect the supply chain participation of sub-Saharan African countries with the US and China, meaning it is going to be one of the areas of the world that bears some of the brunt of this trade war.

So the spillover effects could be very, very negative.

DD: Jeff, is this a price worth paying? What kind of impact could we see on growth?

JF: I don’t think of it as a price worth paying, I think of it as an evolution of the world system where hopefully we’ll get higher growth everywhere. And this is where I differ with the mainstream economics view which focuses far too much on trade and on minor productivity gains.

The world has grown through the success of industries. The US prosperity from 1900 to 1970 was due largely to the automobile industry. What you saw was huge productivity gains as Henry Ford and all his successors invented and developed mass production. You saw wage increases and spending increases and we had the most prosperous economy in the world.

So what we need is industrial growth and when you look at a national security framework, we cannot be dependent on China for as many goods as we are today. We are far too dependent on China here in the United States, Europe is far too dependent on China. So what’s the resolution? Well the resolution is pretty obvious – we need to make certain goods here in the US.

Produced by: Rosemary McCabe, Rhoda Buchanan and Harriet Whitehead

Top picture credit: Getty Images

This transcript has been edited for clarity and brevity.

BBC InDepth is the home on the website and app for the best analysis, with fresh perspectives that challenge assumptions and deep reporting on the biggest issues of the day. And we showcase thought-provoking content from across BBC Sounds and iPlayer too. You can send us your feedback on the InDepth section by clicking on the button below.